Council tax is mandatory for the majority of the population living in the UK. There are exceptions when certain individuals are not obliged to pay but usually, this is only temporary. Very few are free from council tax obligation for life.

Not paying your council tax leads to serious consequences which most certainly you would like to avoid. Everyone has to be conscientious when moving house as this is a very sensitive and important step in a person’s life.

Paying or not paying council tax when moving becomes complicated for many reasons. Various mistakes may happen, leaving citizens with a solid fine from their local council for improper council tax payments.

In this post, you will learn anything you need to know about council taxes and moving. Make sure to pay attention to the little details – the most essential of them are highlighted with a blue background.

Table of Contents

What is a council tax?

The council tax in the UK is the taxation system that is forced by the local government of England, Scotland and Wales.

It’s been introduced with the Local Government Finance Act in 1992 and rolled out in 1993 as a replacement of the previous form of property taxation known as Community Charge.

The method for calculating the scale of taxation for each citizen is based on the banding system categorized from A to H type. Variables such as the value of the property you’re living in have an effect on the tax band you belong to.

Since it’s really rare to get into the list of people who are not obligated to pay council tax, the collection rate of this taxation in the UK is the highest, varying anywhere around 97%.

What does council tax pay for?

What do they do with my money from the council taxes? This is a common question everyone thinks about and it’s fine not to be aware of the details.

Primarily, all local services rely on the local authority budget, which is formed primarily from council taxes. You’ve all seen the rubbish truck that helps with the hard job of the junk disposal each citizen generates on a daily basis. Well, the majority of the budget that sustains this local service comes from council taxes.

A lot more local services in your area rely on income from council taxes being paid on time such as:

- Maintenance of parks and local sports centres

- Libraries

- Waste collection

- Maintenance of roads, highways, and streets

- Certain public transport expenses

- Administrative work expenses

Not paying council taxes regularly leads to flaws in the local authority’s function. It gets short on resources and initiates processes that speed up the process of obtaining the uncollected council taxes. Generally, fines and additional charges to any unpaid taxes lead back to regular payments if some refuse to pay their council tax on time.

What happens if you don’t pay your council tax?

Bad things only. The first reaction will come from your local council. It will send you a reminder notice with a 7 days period for paying the due amount. Not paying again will result in receiving a second reminder notice for unpaid council taxes.

The 3rd notice is the last one you’ll receive and if payment is not made after this last notification, the council takes legal action against you. These are some of the possible outcomes:

- Unpaid taxes will be charged from your monthly wages until everything is paid.

- You can lose access to benefits such as income support, employment allowance, jobseeker allowance, universal credit, pension credit, etc.

- The council may send bailiffs to confiscate your property. In addition to what you owe, the costs for hiring the enforcement agents are covered by the debtor (total costs are added to what has not been paid as council taxes).

If bailiffs don’t manage to confiscate enough property to collect the money for your debt, the court gets engaged with your case.

The takes a decision if there’s a reasonable explanation for not paying your council taxes regularly. If there is no adequate reason to avoid paying taxes, imprisonment of up to 3 months is a possible sentence for the obligor.

Can’t pay the whole council tax all at once? Don’t panic, request from the council to do multiple smaller payments each month. There isn’t a 100% success rate for approval but it’s one of your best chances to make the council tax payments less of a burden.

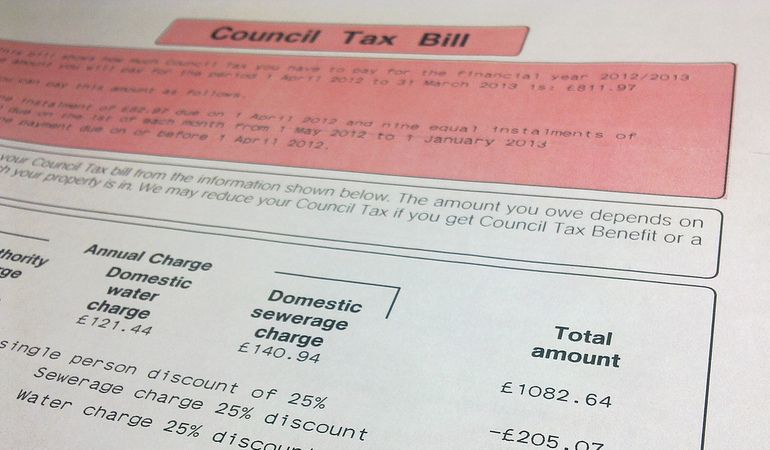

Council tax overlap when moving house

A council tax overlap happens when people move from one property to another and the dates for the old property sale and the new property purchase overlap.

If you have bought a new house on the 5th day of the month and started living there immediately but managed to officially sell your previous property on the 15th, you still have to pay council taxes for the period until the 15th day even though you have not spent any time at the old address.

The same is valid for tenancy periods, the tenant is obliged to pay the council tax for the period until the end of the tenancy agreement even if they have vacated the property earlier.

The responsibility for paying the council taxes for the new property starts from the date of the completion of the deal.

For each day a property has been uninhabited you can enrol for an “empty property discount”. Just make sure to check the policy for an empty property tax reduction with your local council specifically.

Laura Howard Worked as an editor at the MoneySuperMarket

Many people make the mistake of not insuring their new home until the day of completion, but buildings insurance is essential from the time you exchange contracts as this is the point when you become legally responsible for the bricks and mortar of your new home. You should insure your home for the rebuild, rather than market value. The good news is this is usually lower, so your premium will be cheaper. The level of cover you need should be stated in your survey or mortgage lender’s valuation.

How is council tax calculated?

An 8-band system determined the amount of council tax each UK resident has to pay for living in a rented or owned property for the last year.

Each band is labelled with a letter from A to H. The D band is considered nominal because each local authority declares a fixed tax rate for it. Each local council has a nominal tax band, based on which the rest of the tax bands for the council are calculated.

Citizens living in band A properties pay the lowest council tax for the area they live in, while owners of band H homes pay some of the highest council tax in the UK.

You can easily check the council tax band for your property online by filling a field with your postcode.

England council tax bands in values

All properties in the UK fall in any of the tax bands from A to H. If you’re living in a newly built property, the Valuation Office Agency of England and Wales (VOA) is responsible to place a council tax band on your property as soon as possible.

These are the factors that influence the property band evaluation process the most:

- Property size

- Location

- The condition of the structure

- Market value based on prices from 1 April 1991 in England. If the building is new, its value is compared to the one of a similar property in 1991.

The table below illustrates each tax band in England as well as its relevant range of value in GBP.

| Council tax band | Ranges of value |

|---|---|

| A | Up to £40,000 |

| B | £40,000 – £52,000 |

| C | £52,000 – £68,000 |

| D | £68,000 – £88,000 |

| E | £88,000 – £120,000 |

| F | £120,000 – £160,000 |

| G | £160,000 – £320,000 |

| H | >£320,000 |

Is changing council tax band possible?

Yes, it’s possible. However, there’s no guarantee that after a re-evaluation your property will fall into the lower tax band.

Don’t hesitate to make a request to the VOA for council tax band review if significant changes to the property have been made. Having suspicions or information that you’ve been paying higher taxes than someone else in your borough with a similar property is also an alarming sign that something’s probably wrong with the council tax valuation of your home.

Miscalculations and false attempts to pay less in council taxes might lead to the opposite results. Do not attempt to trick the council tax collection system in the UK. There are instances when landlords have their properties re-evaluated into the more expensive tax band after their request for an additional review process by the VOA.

Always make sure that there are adequate reasons to disagree with the current council tax band of your property. The VOA will ignore any suspicious attempts to avoid council tax payments. Applying any facts or documents to prove your point will help you to increase the success rate of causing the VOA to take quick action.

How to cancel council tax when moving house?

Informing the correct local authorities is the most important step of the council tax cancellation process. Of great essence are things such as:

- Knowing exactly when you will move

- Have the exact location details of the new address you’ll live at

- Wait until your application is processed in the waiting list

- In case you move into an area with a different local council, contact both of the authorities – your current and your future one.

To avoid delays due to a long waiting list, we suggest you apply for council tax cancellation at least a month before you move out from your old property. This way you will stop paying your taxes for living at the old address soon after relocating.

We Can Help You Move House

Enter your postcode to view our rates and availability in your area.

For questions about the services we offer visit our main site or you can always call us at 020 3746 0584

How much is council tax on average?

The average cost of a council tax in London for band D is around £1 400. However, an increase of about 5% should be added to the average council tax as of 2024/2025. The increase in the tax is due to the following procedures that have become more expensive as well:

- Adult social care precept costs increase with 3% on average

- Most councils increase their share with about 2%

- Policing and community safety share has increased for many councils with about 7% for the last year.

- Fire and rescue services share increased with 2%

Based on the 5% higher council taxes for the current financial period, you can expect a similar increase for the next two years. Taxation will also go up as there are multiple government sectors that rely on financial help from the budget, generated by council tax payments.

Average council tax per type of valuation band

The table below represents example values of the council taxes for each tax band in the UK. The case shows data for the years 2024 and 2025.

| Valuation band | Average council tax for 2024/2025 |

|---|---|

| Band A | ~ £924.51 |

| Band B | ~ £1078.59 |

| Band C | ~ £1232.68 |

| Band D | ~ £1386.77/td> |

| Band E | ~ £1,694.94 |

| Band F | ~ £2,003.10 |

| Band G | ~ £2,311.28 |

| Band H | ~ £2,773.54 |

*Costs worked out by applying a ratio based on the average cost of Band D (Source: gov.uk and lbhf.gov.uk)

Check the average council tax for 2024/2025 in Liverpool.

How to pay council tax when moving house?

There are 3 suitable options available. Each provides its pros and cons:

- Paying the whole council tax all at once.

It’s the ultimate solution for those who have the amount and can spend it at one time without making any sacrifices. A reduction is usually available for those who pay their council tax at once. - Paying bills over 10 months.

This is the most common and recommended method for paying council taxes in the UK. - Paying over 12 months.

It’s a new form for settling up the council tax. This payment method requires a request in advance though. If the local authority agrees on it, you’ll pay everything in 12 equal payments throughout the entire year.

Learn more about UK council tax payments and how to reach out to the local authority in case you want to take advantage of the 12-month payment option.

When do you start paying council tax after moving?

Most people who move out into a new house are not sure since when they will have to start paying the council tax for the new property.

You start paying your council tax from the day you’ve moved into the new home.

Directing the debt from the previous address is possible only when a person is moving within the same local authority. In any other case, a citizen should send an application for cancelling their council tax payments for the property at the old address.

Do not wait for the new local council to send a notification for unpaid local council taxes. Instead. Immediately notify the local authority that you have changed your address. Any delays will lead to the application of penalties for delayed council tax payments.

When notifying the local council in the area of the new address, you’ll have to provide personal details if you’re living with someone, when you moved and to inform the council if you have bought the property or are living on rent.

Unsure about your exact local council authority? Don’t worry. You can find your local council online. This tool gives further directions when you enter a postcode.

Who doesn’t have to pay a council tax in England?

Before mentioning the few exceptional cases when people can afford to skip taxes payments, we better clarify who are obliged of tax payments for sure.

If you fall into any of the categories below, it means you are legally forced to pay taxes and you better do it on time to avoid fees from your local council.

- Over 18 years old and lives in a rented or own property

- Living in a property with a spouse/ a partner. The responsibility for tax payments is spread evenly between both sides.

25% discount is available for everyone who’s living alone or everyone else living in the property is below 18 years old.

If no one living in the property is an adult the tax decrease is 50%.

Students don’t have to pay council taxes

A full-time student can legally skip paying council taxes. If everyone in a property is a full-time student, no one has the obligation to pay the local council the standard taxation for living in the rented or owned property.

The number of people, each of them free from council tax obligation, living inside the same property is unlimited as long as each of them has the status of a full-time student.

If a full-time student is living with an adult who has to pay taxes, the student is free from paying any council bills, while the other adult takes complete responsibility for timely council tax payments, with the whole 100% charge.

As a student, you might also be interested in what are the cheapest areas to rent in London. Check out our post on the topic.

Mentally impaired people

When living with a mentally ill person or someone who has a condition that affects their intelligence or/and social functioning, you can opt-in for a 25% council tax discount. The mentally impaired person should have a certificate that proves his condition.

Apply for a council tax discount by filling in your postcode. You will be provided with a confirmation that tax reductions are possible for your particular case.

Who else doesn’t have to pay council taxes?

- Young men and women under 25 years old who receive financial help from the Skill Funding Agency or Young People’s Learning Agency

- Student nurses

- Language assistants from abroad, who’re registered with the British Council

- Severely mentally impaired people

- Diplomats

- Live-in carers who are taking care of a person who is not a spouse, partner or family member

Not paying council taxes is allowed temporarily for some people. Once they change their status after graduation or for another reason, they receive the status of working adults who are fully obligated to pay council taxes in full amount for the lawful period of time just as the rest of the population, living in the UK.

Takeaways

We sincerely hope our post helped you find out the best solution for your council tax when moving. If you need help with anything else check out our other blog posts.

Also, give us a call when the time to move out is near to arrange your home moving service.

Check also:

Change of Address Checklist when Moving Home

(7 votes, 85.71 % )

(7 votes, 85.71 % )